A Biased View of Kam Financial & Realty, Inc.

Table of ContentsNot known Facts About Kam Financial & Realty, Inc.Everything about Kam Financial & Realty, Inc.See This Report on Kam Financial & Realty, Inc.The Main Principles Of Kam Financial & Realty, Inc. Everything about Kam Financial & Realty, Inc.The Kam Financial & Realty, Inc. Statements

A home loan is a finance made use of to acquire or preserve a home, story of land, or other realty. The customer accepts pay the loan provider gradually, usually in a series of normal repayments divided into major and rate of interest. The building after that offers as security to secure the funding.Home loan applications undergo an extensive underwriting process prior to they reach the closing phase. The residential or commercial property itself serves as collateral for the financing.

The expense of a home mortgage will certainly depend on the kind of lending, the term (such as thirty years), and the rate of interest that the lender fees. Mortgage prices can differ extensively depending on the kind of item and the qualifications of the applicant. Zoe Hansen/ Investopedia Individuals and businesses utilize home mortgages to purchase realty without paying the entire acquisition price upfront.

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

The majority of traditional mortgages are fully amortized. Normal home mortgage terms are for 15 or 30 years.

A domestic buyer pledges their residence to their lending institution, which then has a claim on the building. This makes certain the lender's rate of interest in the residential or commercial property should the buyer default on their economic commitment. When it comes to foreclosure, the lender might kick out the residents, sell the home, and make use of the cash from the sale to pay off the home mortgage financial debt.

The lender will certainly request evidence that the debtor is qualified of repaying the finance. This might include financial institution and investment statements, current tax returns, and evidence of existing employment. The lending institution will normally run a credit history check too. If the application is approved, the lending institution will provide the customer a car loan of up to a particular quantity and at a particular rate of interest.

What Does Kam Financial & Realty, Inc. Do?

Being pre-approved for a home mortgage can give buyers an edge in a limited real estate market because sellers will know that they have the money to support their offer. Once a buyer and seller agree on the terms of their bargain, they or their reps will meet at what's called a closing.

The seller will move possession of the residential property to the customer and get the agreed-upon sum of cash, and the buyer will certainly sign any type of remaining mortgage records. The lending institution might charge fees for stemming the loan (sometimes in the kind of points) at the closing. There are numerous choices on where you can get a mortgage.

The Best Guide To Kam Financial & Realty, Inc.

The basic type of mortgage is fixed-rate. A fixed-rate mortgage is additionally called a standard mortgage.

Kam Financial & Realty, Inc. Can Be Fun For Everyone

The whole lending equilibrium comes to be due when the consumer dies, moves away completely, or offers the home. Within each type of mortgage, consumers have the choice to get discount rate points to acquire their rates of interest down. Factors are essentially a charge that borrowers pay up front to have a reduced rate of interest over the life of their financing.

Our Kam Financial & Realty, Inc. Ideas

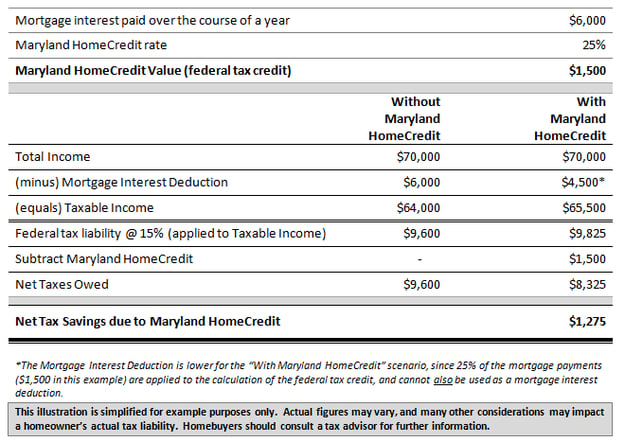

Exactly how a lot you'll have to pay for a mortgage relies on the type (such as repaired or flexible), its term (such as 20 or 30 years), any discount rate factors paid, and explanation the passion rates at the time. mortgage loan officer california. Rate of interest can vary from week to week and from lender to loan provider, so it pays to search

If you default and seize on your home mortgage, nevertheless, the bank may end up being the new owner of your home. The cost of a home is usually much higher than the quantity of cash that the majority of households conserve. Consequently, mortgages allow people and family members to acquire a home by putting down only a reasonably small deposit, such as 20% of the acquisition cost, and obtaining a finance for the balance.